Financing / Lease to own / Payment Plans

What Is Lease-to-Own? Lease-to-own is a flexible payment option that allows you to acquire furniture by making affordable, regular payments over time, with the opportunity to own the item after completing all payments or through an early buyout. Companies like Acima, Koalafi, and Snap Finance specialize in offering lease-to-own solutions, particularly for customers with less-than-perfect credit or no credit history, making it easier to furnish your home without needing traditional financing.

How It Works: if approved for a lease-to-own plan, you make an initial down payment, take your furniture home, and then make regular payments (typically weekly, bi-weekly, or monthly) to the leasing company, such as Acima, Koalafi, or Snap Finance, over a set term, usually 12 to 24 months. Once all payments are completed, you own the furniture outright, or you can opt for an early buyout to own it sooner. This option is ideal for those who want to enjoy furniture immediately while spreading out the cost. Empire encourages you to take advantage of the early buyouts offered by the leasing company.

Benefits of Lease-to-Own

- Low Payments: Payments are designed to be manageable, often spread over 12 to 24 months, allowing you to fit furniture purchases into your budget without large upfront costs. For example, Koalafi and Snap Finance tailor payment plans to your income frequency, ensuring affordability.

- No Credit Needed: These companies look beyond credit scores, using factors like income and banking history to approve customers, making it accessible for those with bad or no credit.

- Credit Building Potential: Companies like Koalafi report on-time payments to credit bureaus, which may help improve your credit score over time, supporting your financial goals.

- Flexibility: You can shop at thousands of retailers, both online and in-store, for furniture, mattresses, and more, giving you a wide range of choices.

- Immediate Use: You can take home your furniture right away while paying over time, avoiding the need to save up for a large purchase.

We understand life can bring financial challenges, but we’re here to help you create a warm, inviting home. Apply by messaging us on social media, online at empirefurnitureoutlet.com, or through our partners’ apps. Let Empire Furniture Outlet make your dream space a reality today!

Koalafi

Koalafi: Flexible Lease-to-Own FinancingKoalafi offers lease-to-own and loan financing for furniture, mattresses, tires, auto parts, and more, with approvals up to $7,500, even for those with limited or no credit. Enjoy your purchase now and pay over time with manageable payments. Koalafi’s early buyout option lets you pay off your lease early to save on costs—choose the promotional early purchase option (often within 90 days, 92 days in CA) to pay only the purchase price, taxes, and fees, or use the standard early buyout for a reduced balance based on your lease terms.Requirements to Apply:

- Age and Residency: 18+ and U.S. resident for at least 60 days.

- Identification: Valid SSN or ITIN.

- Income: Reliable income source (e.g., employment, retirement, pension).

- Bank Account: Active checking account or debit card for payments ($79 or less initial hold may apply).

- Contact Info: Valid email and phone number.

- Credit Flexibility: No credit needed; Koalafi uses alternative credit bureaus for approvals.

Apply online atkoalafi.com, via the Koalafi app, or at participating retailers. Get a decision in seconds with a soft inquiry that won’t affect your FICO® score. Check your early buyout amount anytime in the Koalafi customer portal or app.

Acima Leasing

Acima Leasing lets you shop for furniture, appliances, and more at Empire with no hard credit inquiry. Get approved for up to $5,000 and enjoy flexible payments that match your payday. Empire’s here to help you build your dream home, hassle-free!What Acima Needs to Qualify:

- Active checking account with $750+ monthly income (no Cash App or online banks).

- Valid, non-expired government ID.

- Social Security Number or ITIN to verify identity and prevent fraud.

90-Day Buyout (Empire’s Pick):

- Pay off in 90 days (3 months in CA) for the Acima Cash Price + a small fee (~$25, varies by state) to own it fast and save.

Acima offers 12-month plans, but longer terms raise costs due to lease fees. Empire recommends the 90-day buyout for the best deal!

To Apply Click on any image on the left or the link below.

Affirm

Struggling to furnish your home on a tight budget? At Empire Furniture Outlet, we offer Affirm alongside Acima, Koalafi, and Snap Finance to provide buy now, pay later and lease-to-own options—no credit needed! Affirm’s real-time approvals and flexible payments make it easy to create your dream space, even during tough times. We’re here to help with financing that fits your life.

- Instant Approvals: Apply in-store or at empirefurnitureoutlet.com and get a decision in seconds with a soft credit check (no FICO® impact).

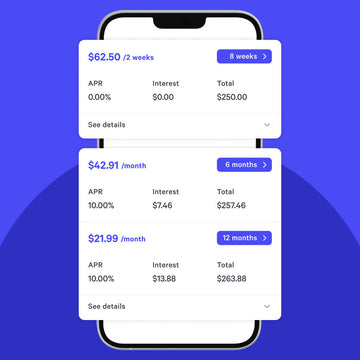

- Flexible Plans: Pick Pay in 4 (interest-free, bi-weekly) or monthly installments (3-36 months, 0%-36% APR, depending on your profile), extending beyond Acima, Koalafi, or Snap’s 90/100-day early payoff periods.

- Cost Comparison (1-Year Example): For a $1,000 purchase over 12 months, Affirm’s rates (0%-36% APR, individualized) might total ~$1,000-$1,150, often cheaper than Acima, Koalafi, or Snap, where costs can reach $1,500-$2,000 if not paid off early (e.g., within 90-100 days). Pay off early with no penalties.

- What Affirm Needs: 18+, U.S. resident (not IA, VT, WV, DC), valid SSN, U.S. phone number, income, and debit card/bank account. No minimum credit score, but rates vary by individual.

Affirm’s longer terms (up to $20,000) and personalized rates make it a cost-effective choice compared to lease-to-own. Apply today at Empire Furniture Outlet to furnish your home affordably! Visitempirefurnitureoutlet.com.